Portfolio Management Certification (PfMP) is a relatively new certification and I am proud and humble to state that I was among the 1st 4 in India who got certified. We were invited by PMI India to do the certification and we readily agreed.

I consider myself really fortunate to do this certification as I see many practical applications when I started ProThoughts. So, what is PfMP or Portfolio Management?

We often have wondered are we doing the “right” thing? We may be doing the things right but are we doing the “right” thing? Is this a step in the right direction? Will my organization or my business unit or my function achieve the goals? Are these the right goals for my organization or the business unit or the functions?

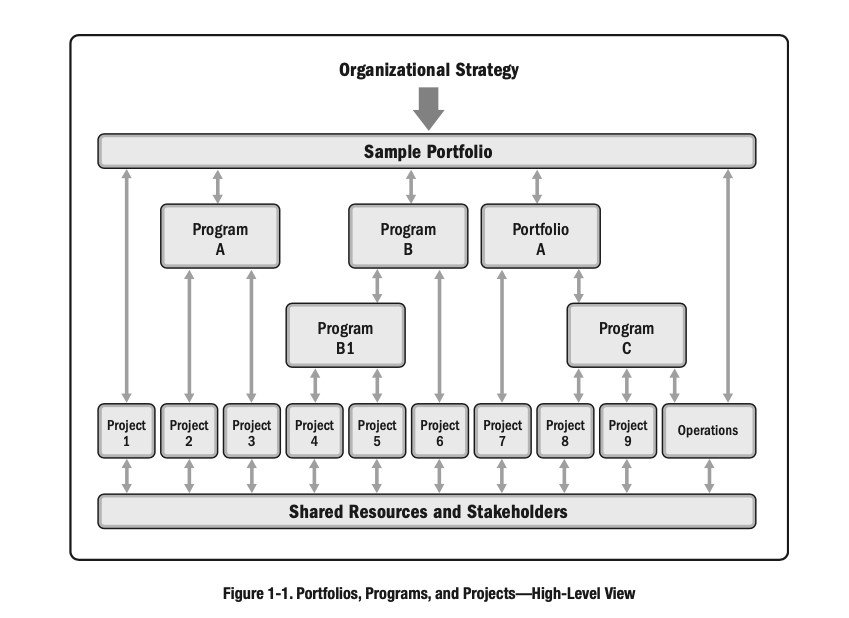

Well, these and many more questions are answered by using some scientific tools and techniques and good practices with PMI’s PfMP certification. The portfolio itself can have various sub-portfolios as its sub-components. These portfolios can be either centralized or decentralized. For example, the R & D portfolio can be a decentralized portfolio managed by an R &D Portfolio Head who can report to the Organization Portfolio manager. A Portfolio has Programs and Projects as its sub-components. Therefore, a portfolio is a collection of programs, projects, sub-portfolios, and operations managed as a group to achieve strategic objectives. The portfolio components may be related or unrelated, independent or interdependent, and may have related or unrelated objectives.

Source: Standard for Portfolio Management Fourth Edition

The Portfolio does not have an end date and it changes as per the external and internal influences and the Governance board along with Portfolio manager can decide on the next course of action. The Portfolio Manager along with its Governance body can decide to terminate a component or initiate a new component as required. It is significantly different than say a Program and Projects. Each role has its own skill sets and compliments each other role very well.

Portfolios, Programs, and Projects – each have their own objectives and act interdependently to achieve the organization objectives. Every component is needed to achieve its functions. Portfolio Managers are generally top management or senior executives who exhibit a lot of soft skills and rely on good data to manage their outcomes. The interdependency between a Portfolio, Program, and Project will be dealt with in a different blog series.

The following can be a good Audience for Portfolio Management Certification (PfMP) and consider this certification.

- Senior Executives and Governance boards who make decisions regarding organizational strategy

- Management or Senior Executives who develop organization strategy or who are in an advisory capacity to other Senior Members

- Portfolio, Program and Project Practitioners and Aspirants and Experts

- Researchers analyzing Portfolio Management

- Members of Portfolio, Program or Project Management office

- Consultants and specialists in Portfolio, Program or Project management & related disciplines

- Business and technical professionals such as authors, trainers, engines, others who do manage a portfolio of programs, projects, and operational activities

- Entrepreneurs who handle portfolios and steer their companies

- Operations Managers who have financial, human, supply chain, marketing considerations in a portfolio

- Portfolio, Program, Project and Operational team members and customers and other related stakeholders

- Strategy planners and executives in organizations

- Educators teaching Portfolio management and related subjects

- Students of Portfolio Management and related fields

There are many challenges in the way of the Portfolio Manager. He / She has some fundamental principles to follow the strategic objectives of the organization. Organizations should always find ways to “do the right projects in the right manner and at the right time”. Some of the core fundamentals principles as followed in Standard for Portfolio Management (4th Edition) PMI are:

- Strive to achieve excellence in strategic

- Enhance Accountability, Transparency, Responsibility, Sustainability, and Fairness

- Balance Portfolio Value vs available risks

- Ensure investments in portfolio components are aligned with organization strategy

- Obtain and maintain the sponsorship and engagement of senior management and key stakeholders

- Exercise active decisive leadership for the optimization of resource utilization

- Foster a culture that embraces change and risks

- Navigate complexity to enable successful outcomes

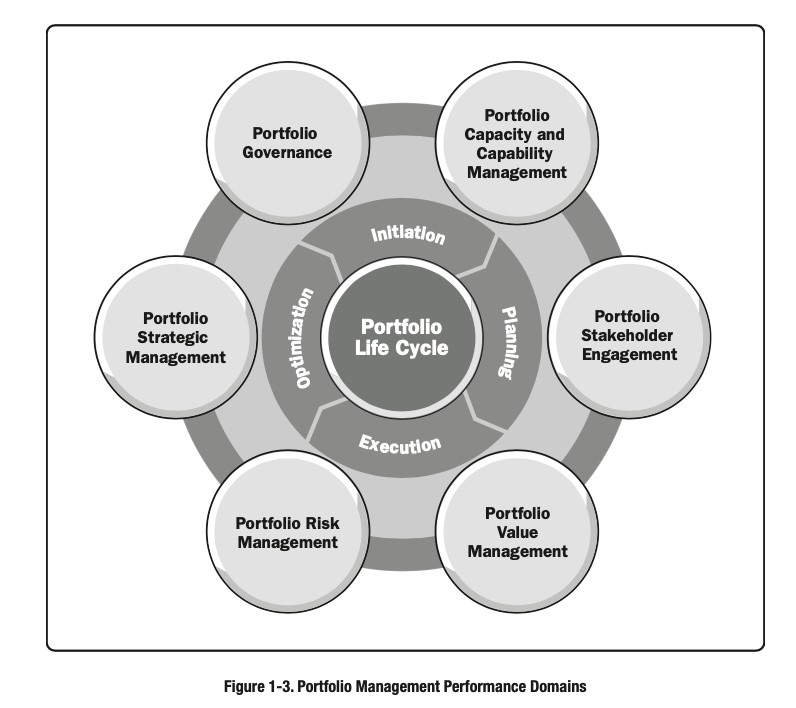

The Portfolio Management certification comes with 6 domains

Source: Standard for Portfolio Management Fourth Edition

- Portfolio Strategic Management– This talk about defining strategy and the organization goals to be achieved. This also defines the components for the Portfolio and how each component should be aligned to one or more strategic objectives and the overall positive impact should be constantly monitored.

- Portfolio Governance – This domain plays a crucial role in ensuring the portfolio stays on its path to achieve the goals. So, establishing the governance framework is one of the cruxes of portfolio governance. It will also define the roles and responsibilities of its members and portfolio components.

- Portfolio Capacity and Capability Management – This will determine if the Portfolio has enough organization capacity and capability to achieve the portfolio goals. What kind of balancing and trad- offs do the different sub-components need to do for resource allocation to achieve the portfolio goals? The portfolio view allows for future planning to develop capacity and capabilities as required.

- Portfolio Stakeholder Engagement – It is important that the Portfolio manager engages its different stakeholders to manage their expectations. Generally, the portfolio does not have the authority and need to engage with other powerful stakeholders to get the job done. By constant engagement, portfolio managers enable the probability of portfolio success.

- Portfolio Value Management – This enables investment in a portfolio to yield the expected return as defined by the organizational strategy. Value contribution and sustainment should be monitored throughout the component execution as well as post the component closure.

- Portfolio Risk Management – This evaluates the risks (opportunities and threats) at the portfolio level and how this impacts the achievement of portfolio objectives. This requires consistent monitoring, both within the internal and external environment of the portfolio.

- Portfolio Lifecycle – As in the case of Programs and Projects, Portfolios also have their own lifecycle of Initiating, Planning. Executing and Optimization to achieve the desired goals.

Value of PfMP Certification:

Why people do certification? There can be many reasons and each to his own. We meet many practitioners who do their certification training with us and therefore, get a good idea of why many do their certifications. Most of them want to change their jobs and see the certification as a great catalyst. And truly so – the demand for the certification increases as employers see value in the certification. There are other reasons as well such as Proof of Professional achievement. Many do the PfMP certification to gain respect in project management circles. It also gives a cutting edge in the space of project management. Many employers see this as a strong asset or knowledge in the organization. However, one thing for sure, it increases your confidence as a Project professional. You, as a Portfolio Manager, are better equipped to handle and manage your portfolios with this knowledge, and you know what, this rubs on your customer and stakeholders. And they start putting a lot of trust and confidence in you and it becomes a vicious cycle, thereby taking stakeholders along with you achieving the portfolio objectives.

So, what’s the value of a certification? Let’s answer the question – What is a certification? Certification provides the knowledge to do a thing more effectively. Knowledge can be in the form of some proven good practices where it has been tried and tested, or it can be set of some scientific tools and techniques that can be used in portfolio scenarios and situations.

So, when you do a certification, you essentially gain the knowledge to manage a portfolio far more effectively. You can better understand the gaps between what you have been doing so far and how other experienced portfolio managers did a good job at that? Isn’t it a deal – for example, for a portfolio, the stakes are much higher maybe millions of dollars and if you do it right, the right thing which is the portfolio, you not only save millions of dollars but also you may end up saving the organization. The stakes are that high – and the knowledge does not harm you at all – it just gives that added edge and makes super effective at work.

The Value, as we discussed, is supreme and in Portfolio management, can save a company as well.

Hope this information is valuable to know about Portfolio Management and what it takes to become PfMP certified and how it can help your career.

For more course details, Click here

Have any questions? Mail us at info@prothoughts.co.in